The impact of Asian market turmoil on the U.S. has little to do with trade policy or leadership failures.

Photo: Bernie Sanders. (Courtesy of Gage Skidmore/Flickr)

Senator Bernie Sanders and Donald Trump, leading candidates for the Democratic and Republican presidential nominations, jumped at the chance to explain global stock market volatility on Monday. Both argued that economic ties with foreign nations damage the U.S. economy, using Monday’s freefall as evidence.

Sanders and Trump are both wrong.

Monday’s global sell-off was a response to continued weakness in China’s economy. Chinese stock markets dropped significantly over the past two months due to low commodity and oil prices, which culminated in an 8.5 percent loss on Monday. The effects of “Black Monday,” as Chinese commentators called it, rippled across Asian and European markets before hitting the U.S.

The Dow Jones Industrial Average has its largest-ever intraday drop—falling over 1,000 points after the open—before settling to lose 588 points, or about 3.6 percent, at the close. The S&P 500 and the Nasdaq, which measure more stocks than the Dow, both fell four percent.

Neither Sanders nor Trump waited for markets to close before declaring that the early-morning stock price freefall was the result of political failures.

On the Twitter account for his U.S. Senate office, Sanders blamed free trade agreements for Monday’s events at 9:09 a.m., before the New York Stock Exchange opened. He didn’t use his campaign handle.

The results are in. Unfettered free trade has been a disaster for working Americans. It is high time we ended our disastrous trade policies.

— Bernie Sanders (@SenSanders) August 24, 2015

Trump followed with two tweets at 9:30 and 9:43 a.m. The first called the U.S. “so tied in with China and Asia that their markets are now taking the U.S. market down,” and the second echoed Trump’s previously stated belief that “incompetent politicians” are to blame for perceived economic failures.

Markets are crashing – all caused by poor planning and allowing China and Asia to dictate the agenda. This could get very messy! Vote Trump.

— Donald J. Trump (@realDonaldTrump) August 24, 2015

But where Trump sees a failure of leadership and Sanders sees a failure of policy, I see a failure of our business environment. Financiers and stock traders are trapped by short-term thinking, for example the automatic trading of futures and ETFs (“technical issues”) that drove Monday’s early collapse.

While she didn’t mention it today, only one candidate has a policy proposal to encourage long-term investment—Hillary Clinton. In July, Clinton said that business leaders are trapped by the “tyranny of today’s earnings report.”

I’m reassured by the market’s response on Monday. Traders overreacted to China’s losses, started to buy again by mid-day, and settled for large, but manageable, losses at the close. Many analysts had already projected a “correction” after a six year period of growth, according to the Boston Globe, and the early-morning 1,000 point decline was caused by the previously mentioned “technical issues.”

“The root of this crisis is not events happening in the United States,” Austan Goolsbee, former chair of President Obama’s Council of Economic Advisors, said on NPR’s All Things Considered on Monday.

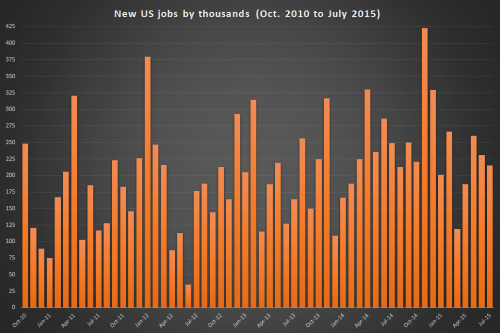

He also highlighted strong U.S. job growth over the past five years as a sign that China’s economic problems won’t push the economy into another crisis.

The reasons behind China’s collapse are two-fold. Chinese policymakers are pursuing a long-term shift from a debt-fueled, government-managed economic growth to a consumer-driven system. But the factors that are hurting China in the short-term—a weak commodity market and low energy prices—actually make the U.S. economy more competitive.

As the market fell lower on Monday, investors streamed to the safety of American and European government bonds. High demand pushed down already-low yields, making public borrowing even cheaper. Somehow I doubt that will encourage Congress to make necessary investments in infrastructure.

The knee-jerk reactions of Sanders and Trump may speak to the disenchanted voters supporting the two anti-establishment candidates.

But jumping the gun rarely results in a good analysis, and frustrated impatience isn’t a trait we should be looking for in our next president.

Zac Bears can reached at zac@dblstand.com.

I like the comparison and well thought out piece based on the publications reported. good job. I think I’m going to remember this part of your post “But jumping the gun rarely results in a good analysis.”

LikeLike